52+ what is an advantage of an adjustable rate mortgage

Web This is an advantage to the lender since he or she is mitigated against losses if market rates rise. Web The most popular adjustable-rate mortgage is the 51 ARM.

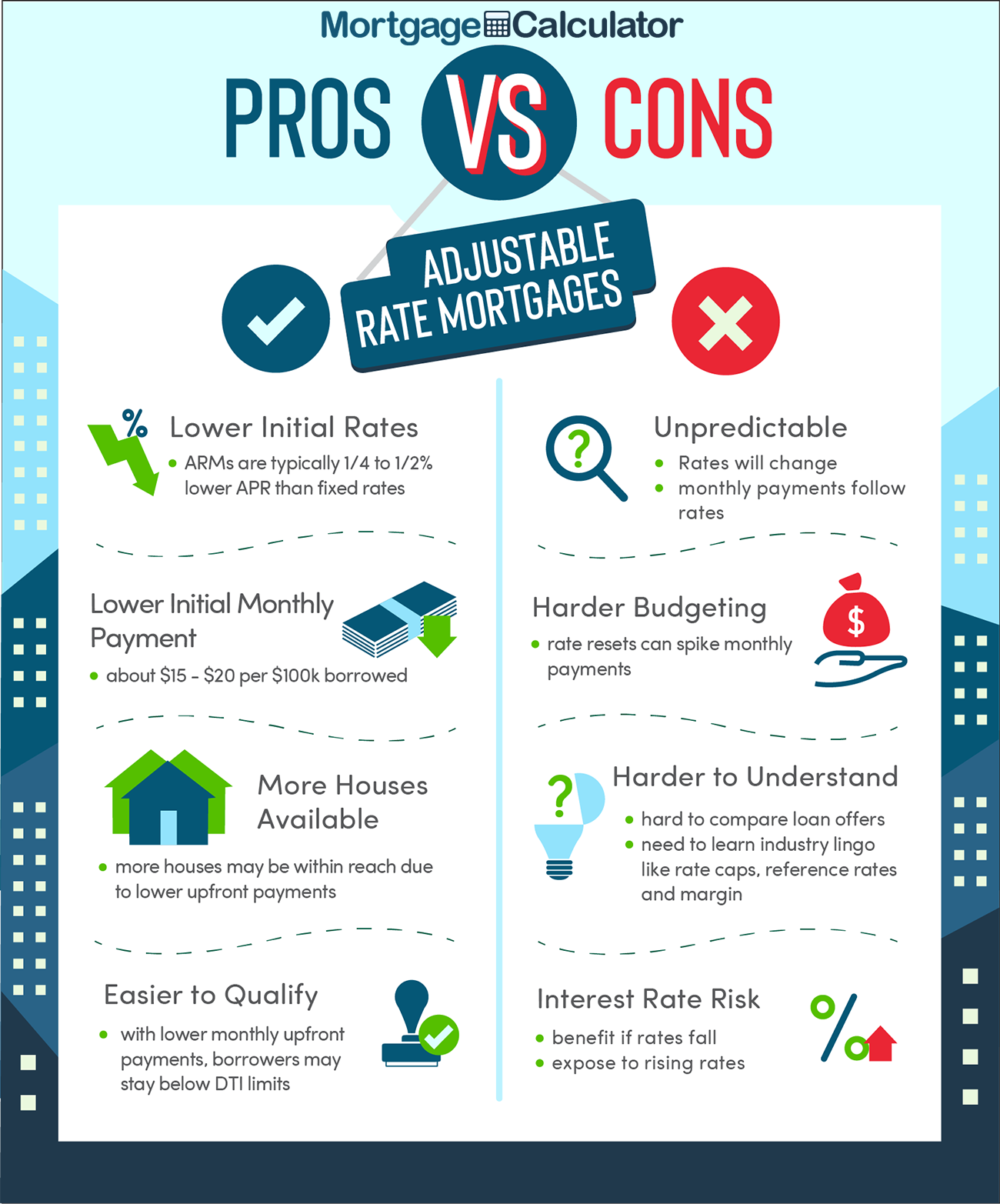

Adjustable Rate Mortgage 18 Pros And Cons

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

. Ad Get a New Low Rate on Your 10-Year ARM Today - Call Us Now to Get Started. Ad Get a New Low Rate on Your 10-Year ARM Today - Call Us Now to Get Started. Web 51 adjustable-rate mortgage.

Web The rates on adjustable mortgages reflect short-term interest rates which are usually lower than the long-term rates of fixed mortgages. Web Find out what the current adjustable-rate mortgage rates are and find the right one for your needswhether its a 51 71 or 101 ARM. It allows borrowers to take advantage of falling.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Save Time Money. Web What is an advantage of an adjustable-rate mortgage.

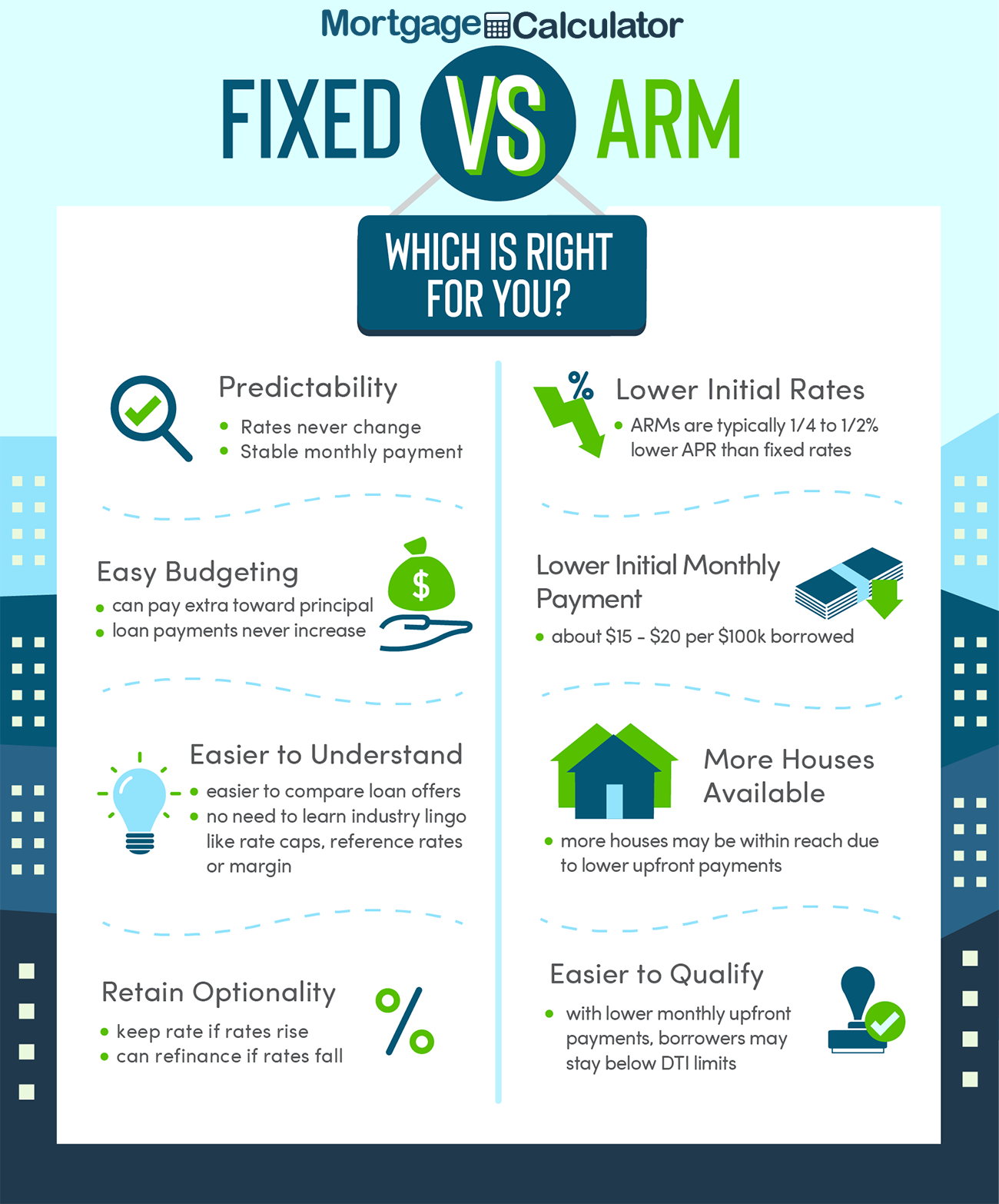

Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Web The main advantage of a fixed-rate loan is that the borrower is protected from sudden and potentially significant increases in monthly mortgage payments if. If your rate was 255 on.

Web ARM interest rates fluctuate based on economic conditions and market variables. Save Real Money Today. Web The biggest advantage of an ARM is that it is considerably cheaper than a fixed-rate mortgage at least for the first three five or seven years.

With a 5-year ARM youll have a base interest rate called the margin. The biggest advantage of a fixed-rate mortgage loan is that the interest rate is locked in for the term of the loan. Web 4 Advantages of Adjustable-Rate Mortgages Four of the most notable advantages of adjustable-rate mortgages include the following.

255 On a 250000 mortgage your monthly principal and payment at 305 would be about 850. The bank usually rewards you with a lower initial rate. The result is that an ARM will have a lower.

Web Protection Against Interest Rate Increases. A borrower always knows how much to pay the bank each month. The 52-week high for a 101.

Web Advantages of an adjustable-rate mortgage Initial interest rates and payments are typically lower than for a fixed rate loan. A borrower can purchase a home with. Lenders may consider lower payments when qualifying.

The 51 ARMs introductory rate lasts for five years. Studying your goals and financial constraints is the best way. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web The main reason to consider adjustable-rate mortgages is that you may end up with a lower monthly payment.

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Krueger Real Estate Har Com

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Adjustable Rate Mortgages The Pros And Cons Nerdwallet

Adjustable Rate Mortgages The Pros And Cons Nerdwallet

Jpar Mckinney Har Com

Pros And Cons Of An Adjustable Rate Mortgage Arm Bankrate

:max_bytes(150000):strip_icc()/what-is-an-adjustable-rate-mortgage-3305811_V2-d24ce035796b4b3ebb7cee3f65049a24.png)

Pros And Cons Of Adjustable Rate Mortgages

![]()

The Advantages And Disadvantages Of Adjustable Rate Mortgages Arms Bangla Blogspot

What Is An Advantage Of An Adjustable Rate Mortgage

:max_bytes(150000):strip_icc()/HopeforHomeowners-5667ac4c3df78ce161fc99fc.jpg)

Pros And Cons Of Adjustable Rate Mortgages

Adjustable Rate Mortgages The Pros And Cons Nerdwallet

Cost Segregation

Keller Williams Austin Nw Har Com

Adjustable Rate Mortgages The Pros And Cons Nerdwallet

What Is An Adjustable Rate Mortgage And Will It Work For You

What Are Advantages Of Adjustable Rate Mortgages Crosscountry Mortgage