How much can i borrow on shared ownership

You can also input your spouses income if you intend to obtain a joint application for the mortgage. Shared ownership is a type of mortgage.

Ultimate First Time Buyer Guide How Much Money Do You Need To Buy A House

Tories face another Black Wednesday if they cant turn the economy around.

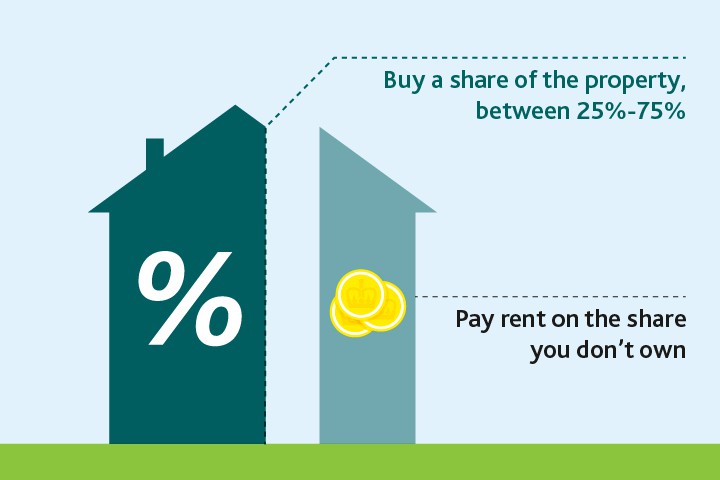

. Keep calm and carry on. You can use the above calculator to estimate how much you can borrow based on your salary. Under shared ownership you can buy either 25 50 or 75 of a property in Scotland with a housing association to which youll pay a reduced rent on the proportion you dont own.

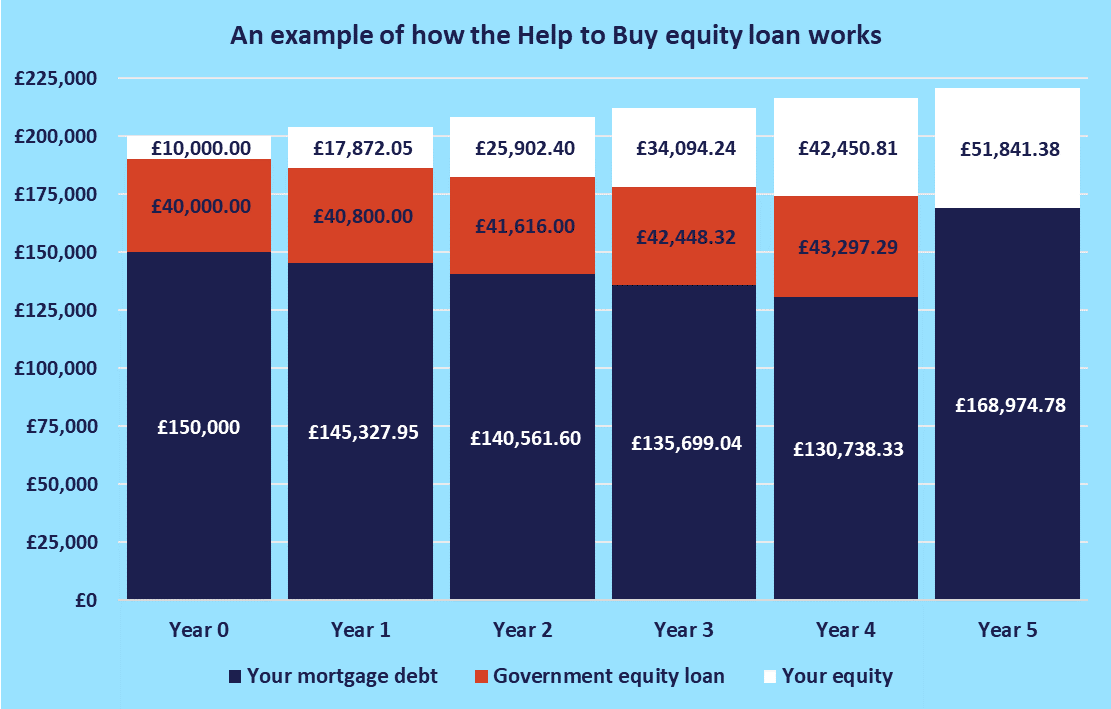

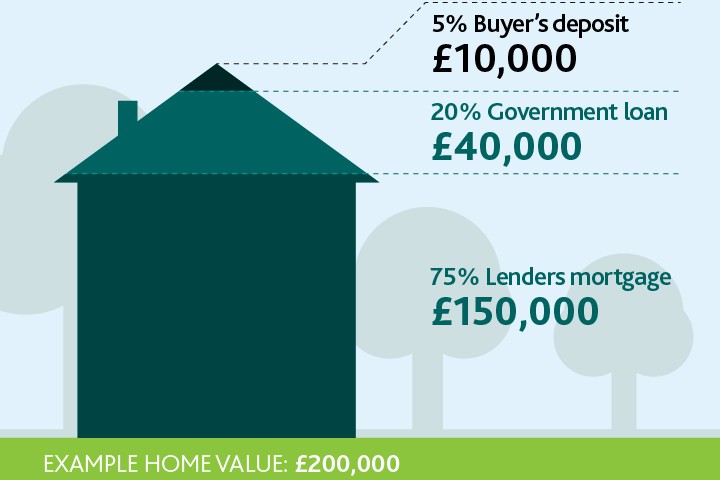

With a Shared Equity mortgage youll receive an equity loan which well treat as part of your deposit. We have a 5-star Trustpilot score from thousands of reviews. Thats where shared ownership mortgages can help.

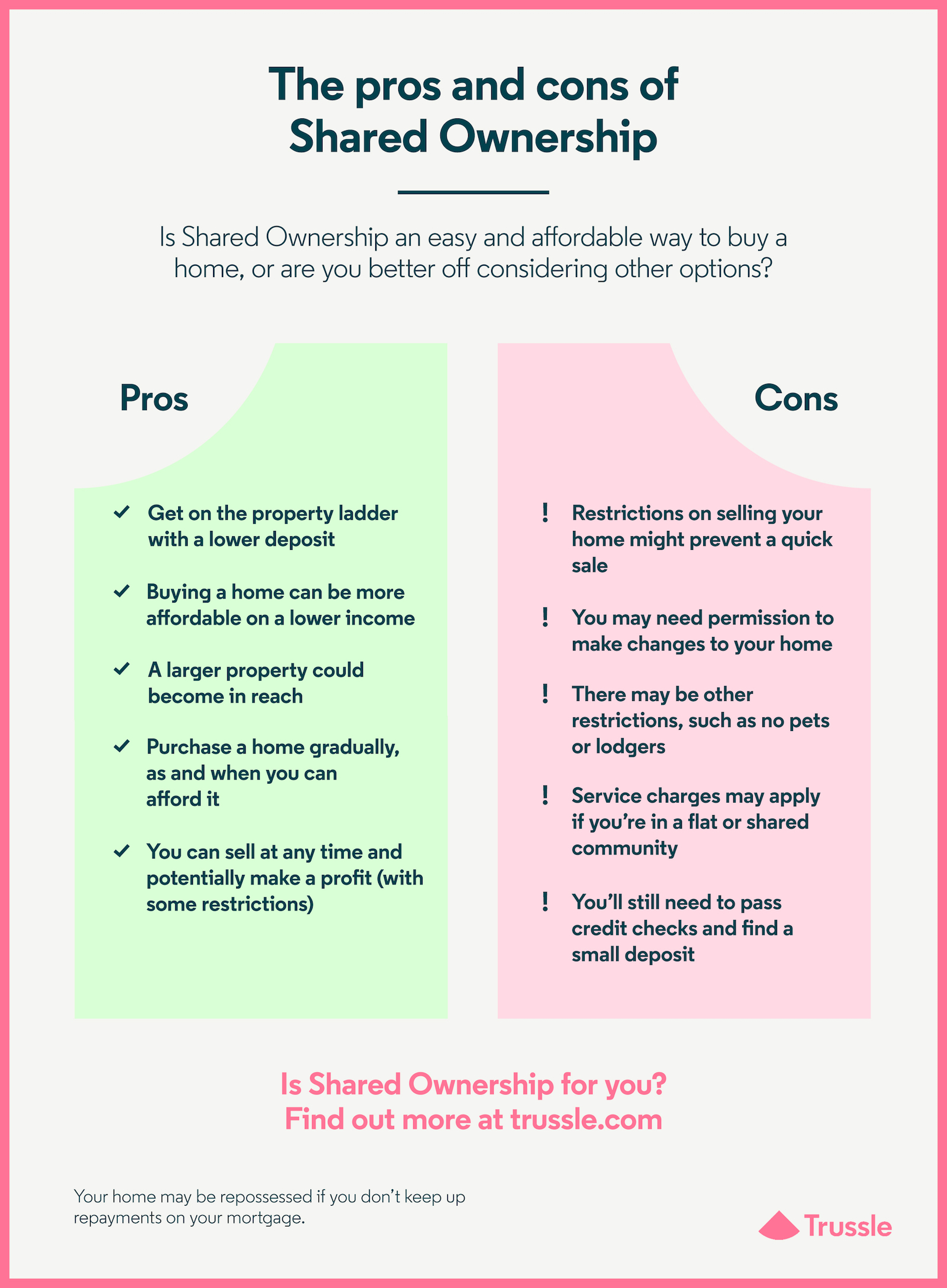

In the future if you wish you can usually buy further shares until you own your home outright. If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own. Shared Ownership provides an affordable way to buy a property.

Customers will need a 10 deposit to buy in partnership with the firm and then make a single monthly payment covering repayments and rent which allows them to effectively borrow. A home or domicile is a space used as a permanent or semi-permanent residence for one or many humansIt is a fully or semi sheltered space and can have both interior and exterior aspects to it. Halifax is supporting the Governments MoD Forces Help to Buy scheme which allows forces personnel to borrow up to 25000 interest free repaid over 10 years to use as a deposit when buying a property.

Youll pay a mortgage on your share then pay rent on the rest. We dont currently offer Shared Equity schemes online so please either give us a call or visit us in branch. Digital lender StrideUp is targeting first-time buyers with the launch of a shared ownership mortgage product that offers loans at up to six-and-a-half times income.

What is a Buy to Let mortgage. Shared ownership Scotland. Like any form of investment theres a lot to consider before you make the.

Shared ownership is only available to first-time buyers those whove previously owned a home but cant afford to buy one now and existing shared ownership homeowners who want to move house. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. Get expert mortgage advice and brokering from the UKs best mortgage broker as voted for by the public.

Joint loan Borrowers take out the loan together and jointly own the property the loan pays for. Both Cosigners and joint borrowers are 100 responsible for the loan including the. Shared ownership what were referring to on this website The same as Help to Buy.

Homes provide sheltered spaces for instance rooms where domestic activity can be performed such as sleeping preparing food eating and hygiene as well as providing spaces. The amount you are able to borrow will help you determine the size of the further share you are. Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage.

The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. Money you owe because of loans credit cards or other commitments. Ralph Waldo Emerson May 25 1803 April 27 1882 who went by his middle name Waldo was an American essayist lecturer philosopher abolitionist and poet who led the transcendentalist movement of the mid-19th century.

For non-homeowners unable to afford to buy housing association homes on the open market. You need to put in. When you buy a shared ownership home you buy between 25 and 75 of its value and pay rent on the rest.

Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive. He was seen as a champion of individualism and a prescient critic of the countervailing pressures of society and his ideology was. The amount of interest charged depends on the cards annual percentage rate APR.

If you want a more accurate quote use our affordability calculator. A Buy to Let mortgage is a loan secured against one of these properties. This loan is repaid either on the sale of the property or the end of the mortgage term whichever comes first.

Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. This guide sets out how the scheme works in England who can take part and.

You buy a share usually 25-75. Help to Buy Shared Ownership. As well as how much rent youll have to pay on the rest of the property.

Youll need to spend a little longer on this. Our mortgage calculator can give you an idea of how much you might be able to borrow. Co-ownership Northern Ireland.

Note this is for flexible shared ownership home loans properties only fixed shared ownership loans can only be sold back to the Housing Authority. Simply purchase a share in a brand-new home and pay a subsidised rent on the remaining. With the shorter loan you will often get the very best interest rate Brown says.

Shared Ownership just with a non-branded name. Remember it provides only an indication. Depending on how much you want your monthly payment to be and how much you have available to put down you may be able to choose between a 15-year or a 30-year loan and many lenders will create a loan for you with custom terms.

You buy a share usually 25-75. Credit card interest is the fee a card issuer can charge when you borrow money with your credit card. The amount you can provide as a deposit Your household income.

You pay rent on the rest. The cosigner has no right to the property but guarantees they will pay the loan if the primary borrower defaults. You only pay a mortgage and deposit on the share you own.

When you part-buy part-rent a home through shared ownership you can apply for a smaller mortgage so your deposit could be lower too. Cosigning One borrower takes out the loan and owns the property it pays for. Bangkok September 6 2022 Bitkub Blockchain Technology Bitkub Chain and Bitkub NFT developer invite you to open the new experience of the digital world and participate in the NFT activities at Bitkub NFT Fair event on September 10-11 at Bitkub M Social Helix Building 9th floor The Emquatier.

Expert mortgage advice by email and phone. A shared ownership mortgage calculator lets you know how much you could borrow. Apply online and youll get our best deals for you usually within 5 hours.

The sovereigns title has changed but the tradition endures. Start online or you can call 1300 578 278 to chat with our team. See My Options Sign Up.

Whether youre buying alone or with someone else. Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. Your household income must be less than 80000 if you live outside London or 90000 if youre living in London.

If youre a first time buyer saving a big deposit can be tricky. Find out how much you can borrow - so youll know how much you can afford before you put in an offer. Its different to a residential mortgage as instead of buying the whole property you buy a share.

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

What Is A Shared Equity Mortgage And How Does It Work Unbiased Co Uk

Shared Ownership Mortgages Explained Nerdwallet Uk

Shared Ownership Guide Trussle

Is Shared Ownership A Good Idea Mortgage Light

Is Shared Ownership A Vital First Step On The Property Ladder Or A Slippery Slope Property The Guardian

Considerations For Shared Ownership Of Family Property

A Guide To The Government S Help To Buy Schemes Foxtons

How Much Of A Deposit Do You Need For Shared Ownership Mortgage Light

A Guide To The Government S Help To Buy Schemes Foxtons

Shared Ownership Mortgages September 2022 Forbes Advisor Uk

What Is A Shared Ownership Mortgage Help And Guidance Lloyds Bank

How Much Of A Deposit Do You Need For Shared Ownership Mortgage Light

Compare Shared Ownership Mortgages Uswitch Uswitch

:max_bytes(150000):strip_icc():gifv()/ESOP_Final_4196964-5ef6212f097d4105823ebe8b6591b5c3.png)

Employee Stock Ownership Plan Esop What It Is How It Works Advantages

Help To Buy And Shared Ownership What You Need To Know About First Time Buyer Schemes In London

We Re Selling A Shared Ownership Home What Is A Fair Price Property The Guardian